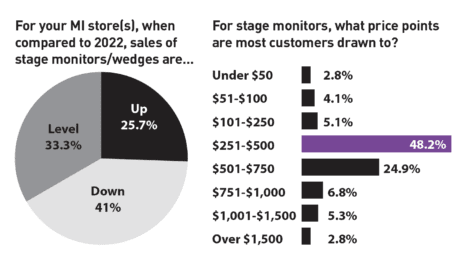

With over 40 percent of participants (41%) in this issue’s dealer survey on the topic of stage monitors reporting sales trending downwards – the largest response by percentage – one could conclude that this market segment is struggling. But it’s hardly a universally agreed upon POV, with 59 percent feeling that sales are either up, or level to 2022 numbers. So…. yeah.

With over 40 percent of participants (41%) in this issue’s dealer survey on the topic of stage monitors reporting sales trending downwards – the largest response by percentage – one could conclude that this market segment is struggling. But it’s hardly a universally agreed upon POV, with 59 percent feeling that sales are either up, or level to 2022 numbers. So…. yeah.

One across-the-board trend being observed by nearly all is the shift towards personal, in-ear monitor systems for live performance. “Everybody seems to be going to in-ears,” observes Encore Music Center’s (Auburn, California) Larry Gosch. “Hard to get used to for us old guys who are used to hurricane wind-level volume coming out of a floor wedge.”

Even on that point there’s not 100 percent consensus, however. Jerry Vesely of Vesely Music Co. in Parowan, Utah asserts, “Wedges have once again eclipsed personal monitor sales.” So, again… yeah.

A host of factors inform how these products have been selling of late: certain areas still have COVID-related restrictions in place regarding large gatherings, some spots within the nation are struggling more than others in terms of job growth and wage disparity, and for many dealers supply chain disruptions remain a problem. As Allen McBroom of Starkville, Mississippi’s Backstage Music puts it, “Lack of product availability is a real issue. Bottom line is, you can’t sell it if you don’t have it.”

For many reasons – economic, regional politics and policy, availability – how well stage monitors are selling and what types of live monitor systems, in general, are connecting with end-users appears to vary considerably depending on the territory.

For your MI store(s), when compared to 2022, sales of stage monitors/wedges are…

Up: 25.7%

Down: 41%

Level: 33.3%

Of those sales, are the majority powered or unpowered?

Powered: 71.8%

Unpowered: 7.7%

Roughly Equal: 20.5%

What brands of stage monitors are selling best at your store?

Yamaha: 58.6%

Electro-Voice: 52.3%

Yorkville: 51.5%

Galaxy Audio: 40.2%

EAW: 36.7%

Peavey: 36.7%

Kustom PA: 32.9%

Laney: 32.9%

Nady: 30%

QSC: 29.5%

PreSonus: 27.9%

Mackie: 27.9%

Behringer: 27.9%

JBL: 23.5%

BASSBOSS: 21.8%

RCF: 21.8%

“Other”: 7.1%

For stage monitors, what price points are most customers drawn to?

Under $50: 2.8%

$51-$100: 4.1%

$101-$250: 5.1%

$251-$500: 48.2%

$501-$750: 24.9%

$751-$1,000: 6.8%

$1,001-$1,500: 5.3%

Over $1,500: 2.8%

What trends have you been noticing with respect to this market segment – preferred materials, features, et cetera?

“In-ears have become way more popular than wedges over the last 10 years or so. They don’t interfere with the house sound, and they sound better. Lots of adjustment to get used to them. Been using them for 10 years, still adjusting, but they are a better choice.”

Bill Cunningham

SoundCheck Music

Decatur, IL

“As churches move from analog to digital they are upgrading to new monitors.”

Marc Rabins

Audio Design & Instruments

Port St. Lucie, FL

“Supply chain and actually getting products is what has limited our sales. In general, active (powered) monitors continue to overtake the sales of passive units in all but the very low cost segment. IEM’s have also cut into the market for wedges, especially in the HOW marketplace.”

Don Williams

Q Systems Music & Sound

Hobbs, New Mexico

“All sales are still down. I think that it will be awhile before sales pickup. I am a Master Luther, so I have both bases covered. When people do not want to spend money on new equipment, they have their old instruments repaired. I am extremely busy with my lutherie work.”

South County Vintage Instruments

St. Louis, MO

“Customers that weren’t working, or were closed, have started up again. church’s that “just got by” are finally upgrading. bands are getting gigs again and buying new gear!”

Dan Patterson

Patterson’s Music

Fort Payne, Alabama

“Most monitor sales are studio monitors. Stage monitor sales have been down so far as live performances are still limited in L.A. County due to the pandemic.”

David St. John

Music & Arts

Glendora, California

“Like most all other stores, we have definitely had supply issues over the last year and a half. Things do seem to be getting a little better on the PA side of things, but still having to strategically order to try and keep up with the supply and demand! We have noticed a lot more customers switching over to in-ear systems, both wireless and hardwired.”

Adam York

The Music Store, Inc.

Tulsa, OK

“Our retail customers want small, lightweight, and the ability to get loud. Our sound company customers want loud, well-tuned boxes. Lately, typically powered.”

George A Rondinelli

Rondinelli Music/Audio

Dubuque, Iowa

“We’re experiencing good numbers on both powered and unpowered units. Our sound reinforcement room is configured to make demoing different models a breeze.”

Jerry Vesely

Vesely Music Co.

Parowan, Utah